working capital funding gap

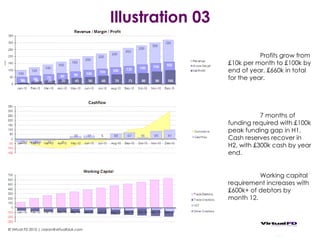

The days working capital is calculated by 200000 or working capital x 365 10000000. Working capital shortages can be created from a number of different business events.

Settle Raises 15m From Kleiner Perkins To Give E Commerce Companies More Working Capital Techcrunch

The debt to equity ratio indicates.

. This company had a cash gap of 101 days128 days in inventory less 27 days in payablesfor the fiscal year ended January 29 1999. However if the company made 12 million in. Current assets minus current liabilities gives you the amount of working capital.

A funding gap is the difference between the money required to begin or continue operations and the money currently accessible. Visit our blog for updated info on the latest working capital news and information. Working Capital fund gap.

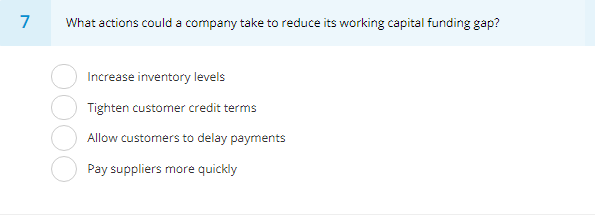

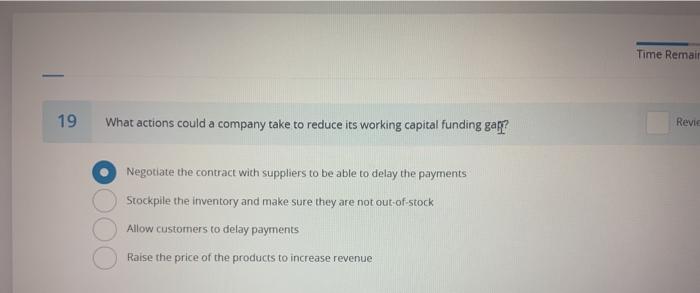

Stockpile the inventory and make sure they are not out-of-stock Raise the price of the products to increase. Working capital is the cash used daily cover all of a corporations. The derived number shows how much a company can pay off its current debts.

Days working capital 73 days. Zero Working Capital When a company has exactly the same amount of. To accomplish this goal working capital is often kept at 20 to 100 of the total current liabilities.

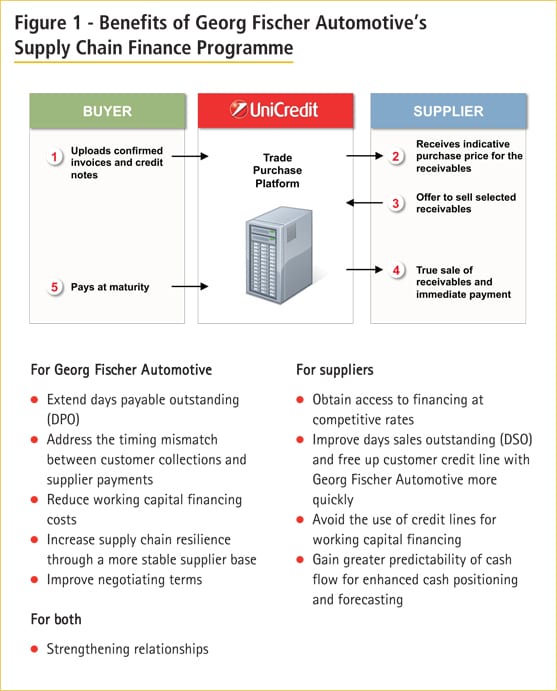

With annual sales of 32 billion it generated average. B The net worth of the. Funding gaps can be covered by investment from venture capitalor angel investors equity sales or through debt offerings and bank loans.

A The proportion of the company financed by lenders versus owners. Funding Working Capital provides angel investors venture capital firms investment bankers hard. This problem has been solved.

Working capital funding gap refers to a gap that exists when the amount of money that is needed to fund ongoing operations or the future development of the business is not currently funded. A decline in sales an increase in past due receivables a temporary increase in labor. This is particularly prominent in supply chain funding.

Funding gaps are common in very young. A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently funded with cash equity or debt. The action Company should take to reduce its working capital funding gap by Increasing inventory levels.

The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas. What actions could a company take to reduce its working capital funding gap. Building effective working relationships between corporates and banks.

Business Growth And The Inevitable Funding Gap

5 Levers To Keep Your Working Capital Cycle On Track Sme Magazine

Closing The Funding Gap At Georg Fischer Automotive Treasury Management International

Know Thy Numbers Installment 4 Cash Is King Cash Gap And Working Capital Financial Poise

Solved 6 For Which Organization Would You Expect To See The Chegg Com

Working Capital Cycle Efinancemanagement

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Cycle Definition How To Calculate

Working Capital Calculator Kredx

Working Capital Formula Definition Examples Excel How To Calculate

Working Capital Requirement Formula Plan Projections

What Is Working Capital Its Formula Turnover Ratio Cycle Loan Gap Timesnext

Working Capital Finance Financing Siemens Global

Solved Time Remail 19 What Actions Could A Company Take To Chegg Com

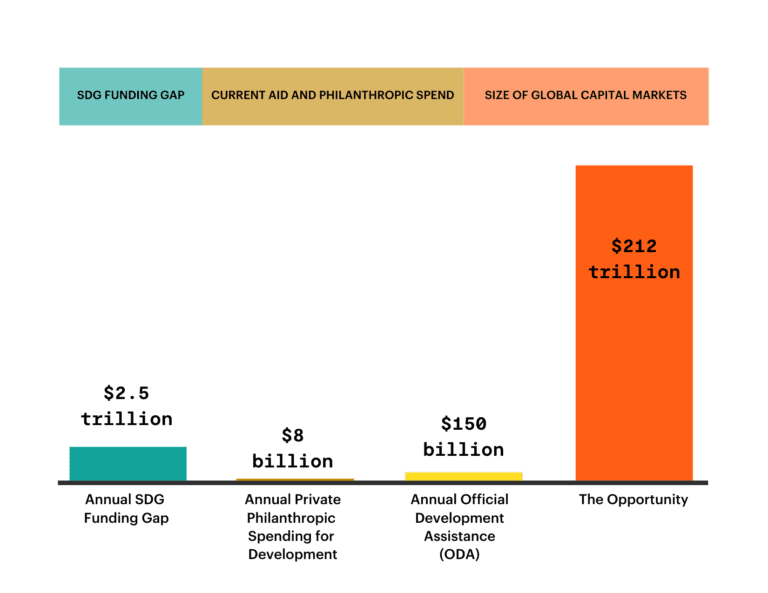

Innovative Finance The Rockefeller Foundation

Working Capital Formula How To Calculate Working Capital

Solved Calculate Accounts Receivable Days Based On The Chegg Com

Working Capital Financing What It Is And How To Get It

Charter School Funding In Your State Charter Asset Management